Introduction

AAVE is a pioneer in decentralized borrowing and a true blue chip DeFi protocol. As one of the largest borrowing protocols in the world, currently managing over 9 billion USD, robust risk management applications are required to empower users and developers with reliable, accurate data. Today we are presenting the initial version of the AAVE v3 Collateral At Risk Dashboard. We'd love your feedback!

🚨 NOTE 🚨 This initial release is meant to generate community feedback. In the meantime, there a few known issues. The current priority is fixing AAVE v3 subgraphs which are a primary data source for this application. We're working with the core AAVE team to deploy a fix. We'll update when those are live!

Goals 🏆

This application focuses on collateral at risk, real-time user metrics and simulations to understand the value at risk across volatile markets as well as APY earned and paid over time. Users and DAO members will be able to make informed decisions around their personal and protocol-wide positions. Let's break down the application functionality by reviewing every tab.

Methodology 🛠️ 👷

AAVE v3 is currently deployed across six different blockchains. Despite being deployed on entirely different networks, our goal is to give a holistic experience and be able to provide aggregated metrics. To this end, we've built an additional data layer on top of AAVE v3 subgraphs. Our infrastructure continuously queries all subgraphs, writes to a single database, and creates aggregated data collections. These collections are indexed and allow for fast querying, low latency and a snappy UX.

Platform Deep Dive 📊 💻

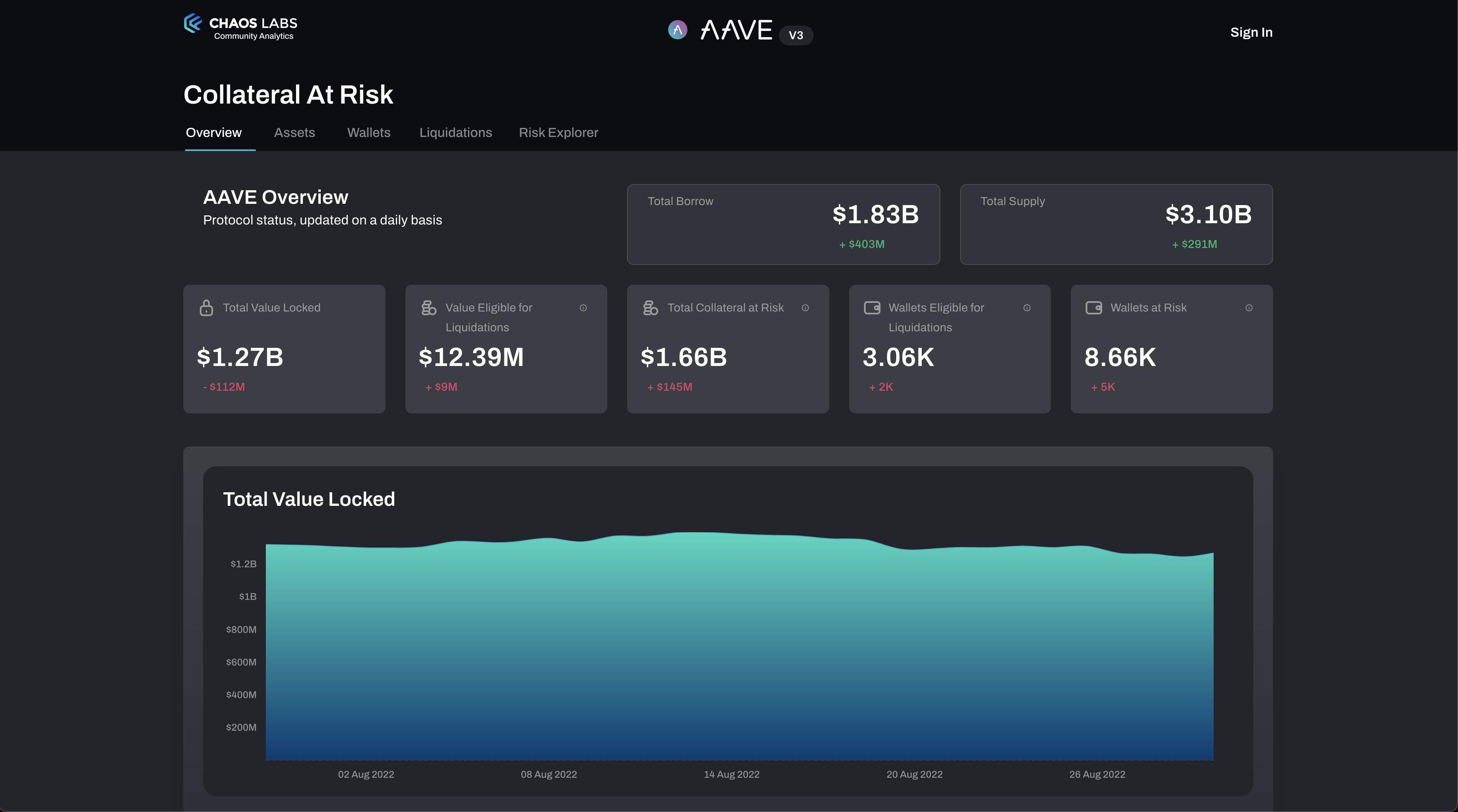

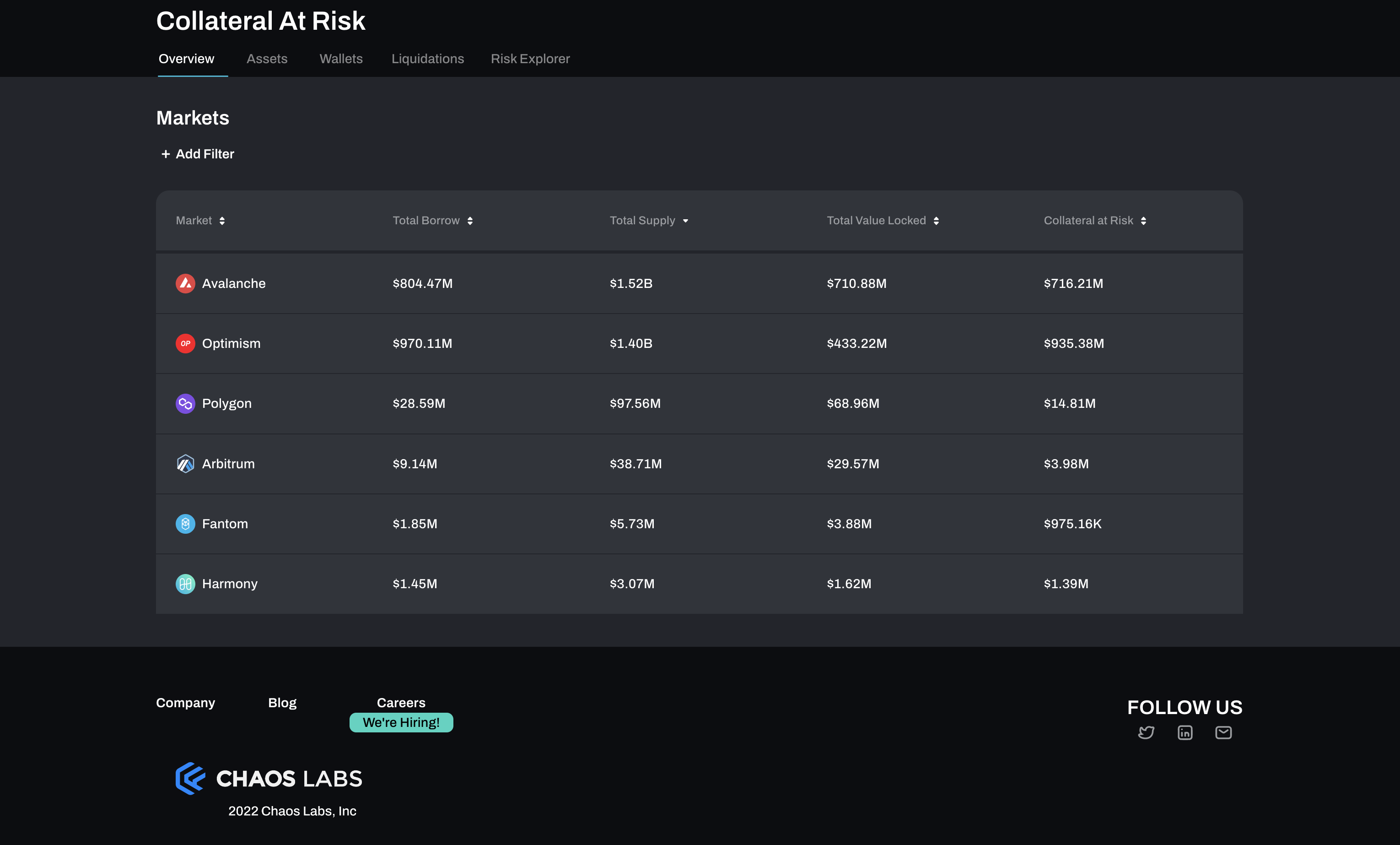

Overview

This page is an overview and aggregation of all v3 deployments across all chains. This includes:

- Arbitrum

- Avalanche

- Optimism

- Polygon

- Fantom

- Harmony

We track here the aggregated TVL across all v3 deployments. We also introduce a few new metrics:

- Value Eligible for Liquidation - total value in positions with health less than one.

- Wallets Eligible for Liquidations - Accounts with health less than one.

- Total Collateral At Risk - Total value in positions with health between 1 and 1.5.

- Wallets at Risk -- Accounts with health between 1 and 1.5.

Additionally, we have an overview of borrow and supply across all networks.

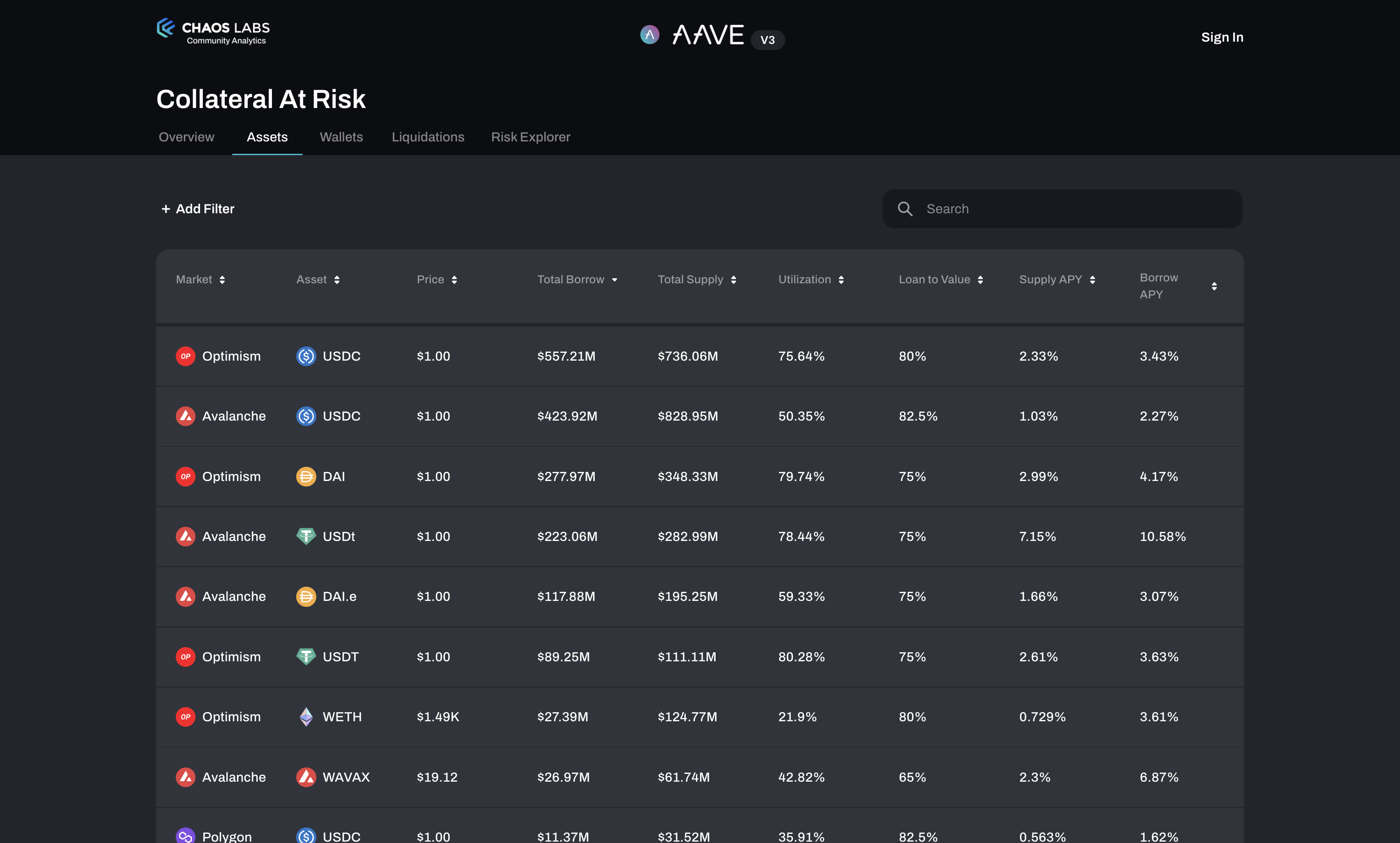

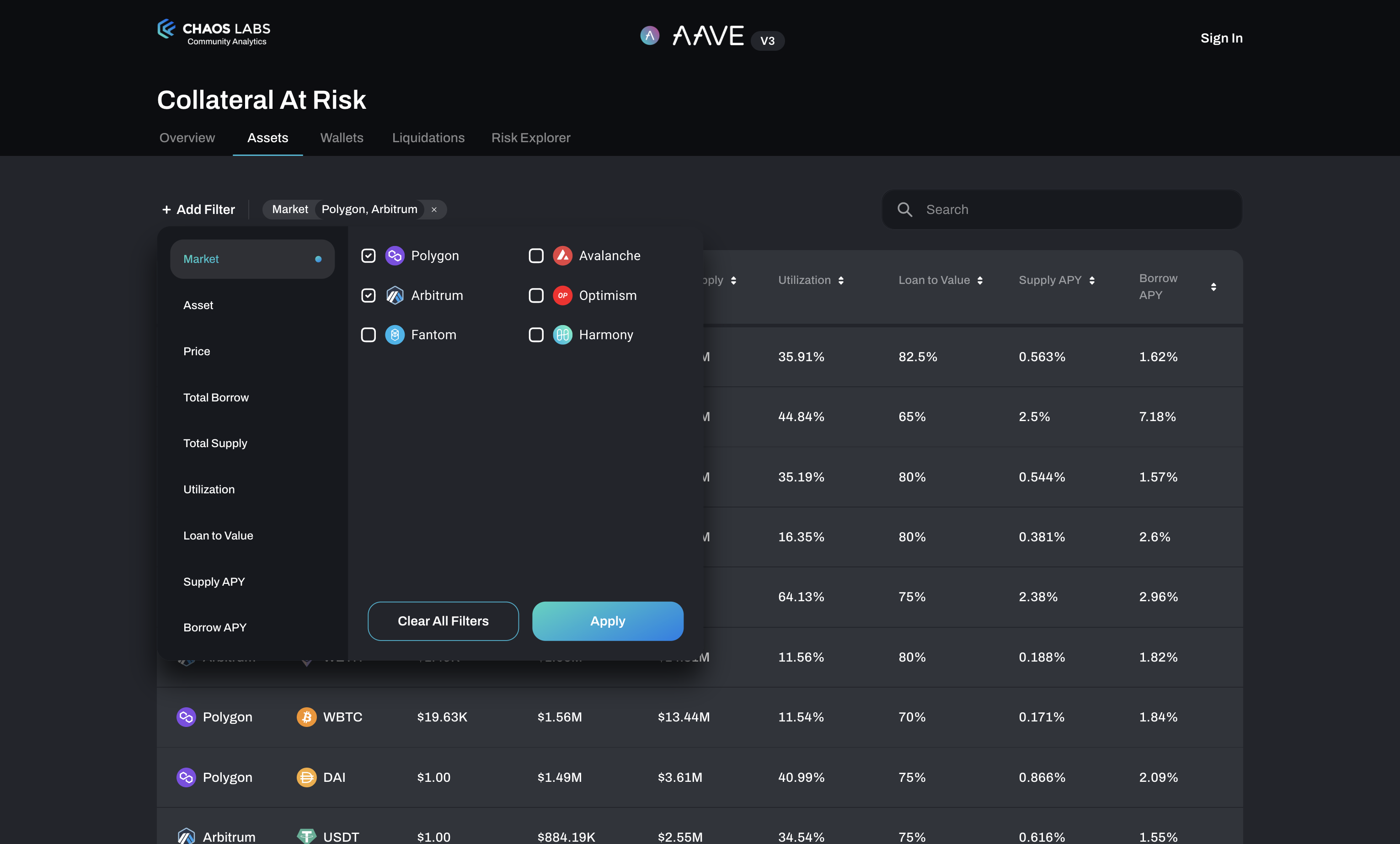

Assets

This page aggregates all supported assets across every network.

The filter functionality is useful for quickly customizing the table to suit your needs.

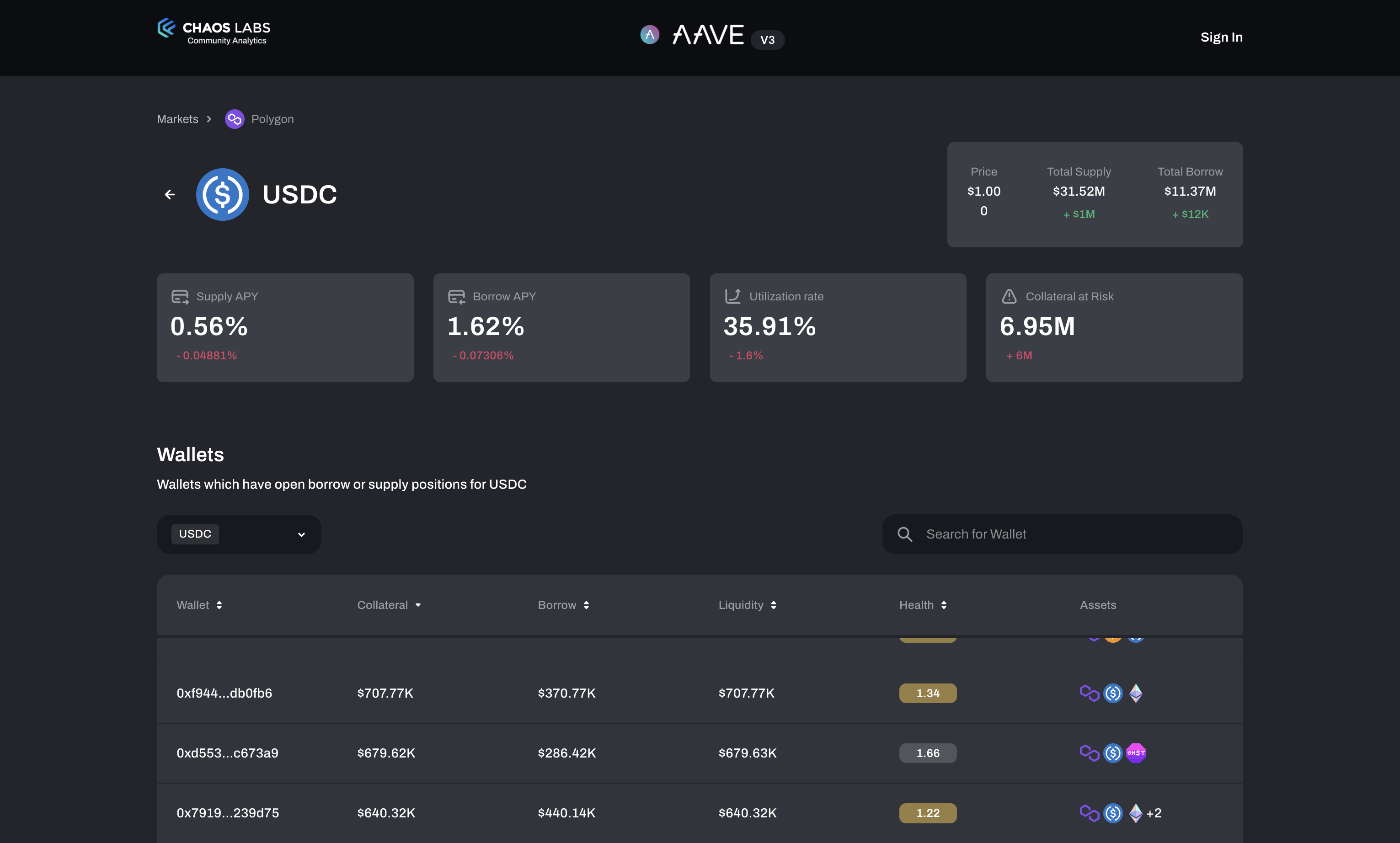

Once you've found an asset your interested in you can click into it for a detailed view.

The detail view allows you to observe and search for any wallet holding the asset. This is useful for drilling deep into accounts, to see how they are interacting with AAVE.

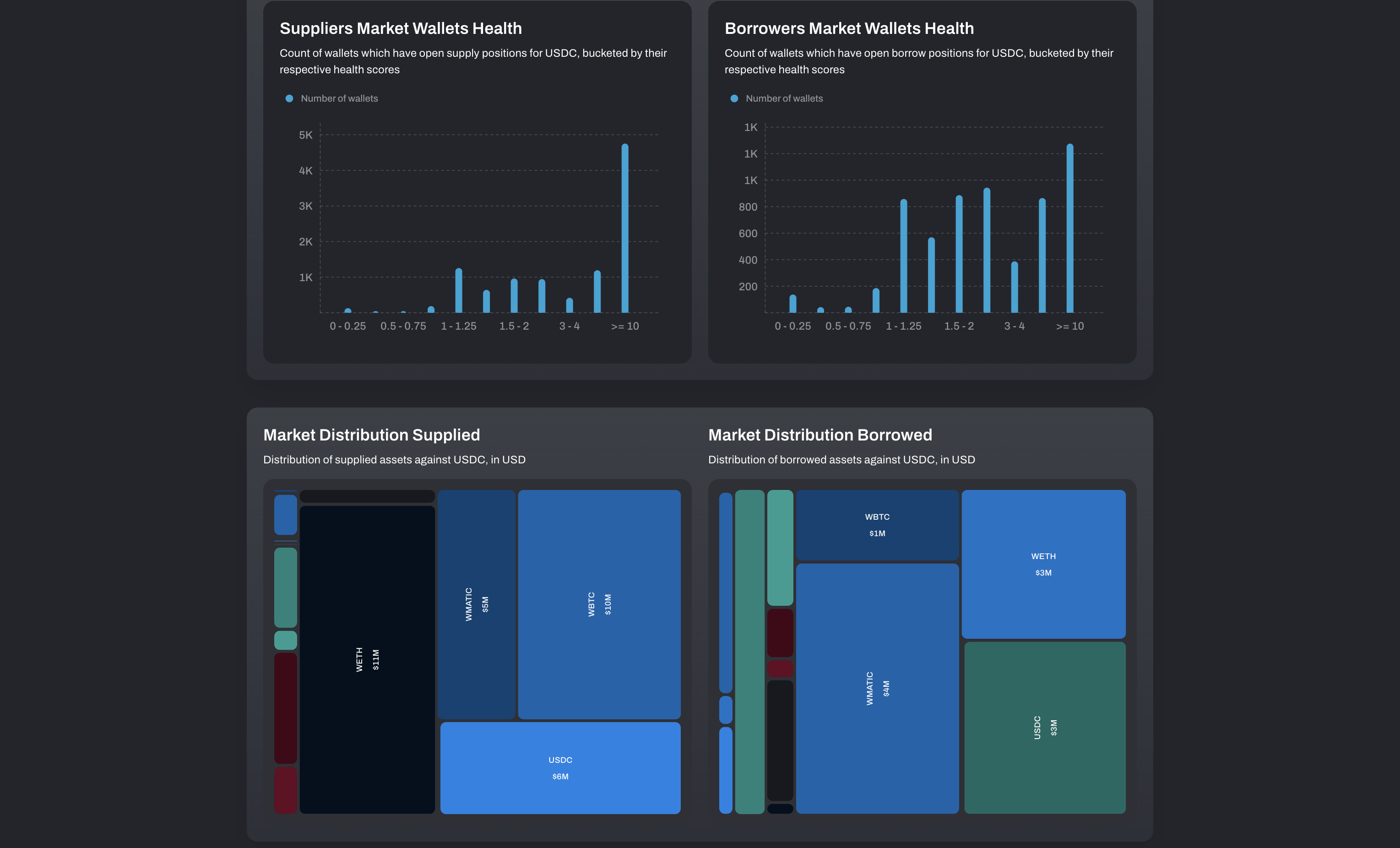

We can also see collateral at risk for the specified asset. This shows us the value to be liquidated (in USD) if prices deviate up or down. We can also observe a histogram of borrwer and supplier health, bucketed by their respective heatlh scores.

Lastly, we can observe a visualization which shows the distribution of assets supplied and borrowed against the current asset.

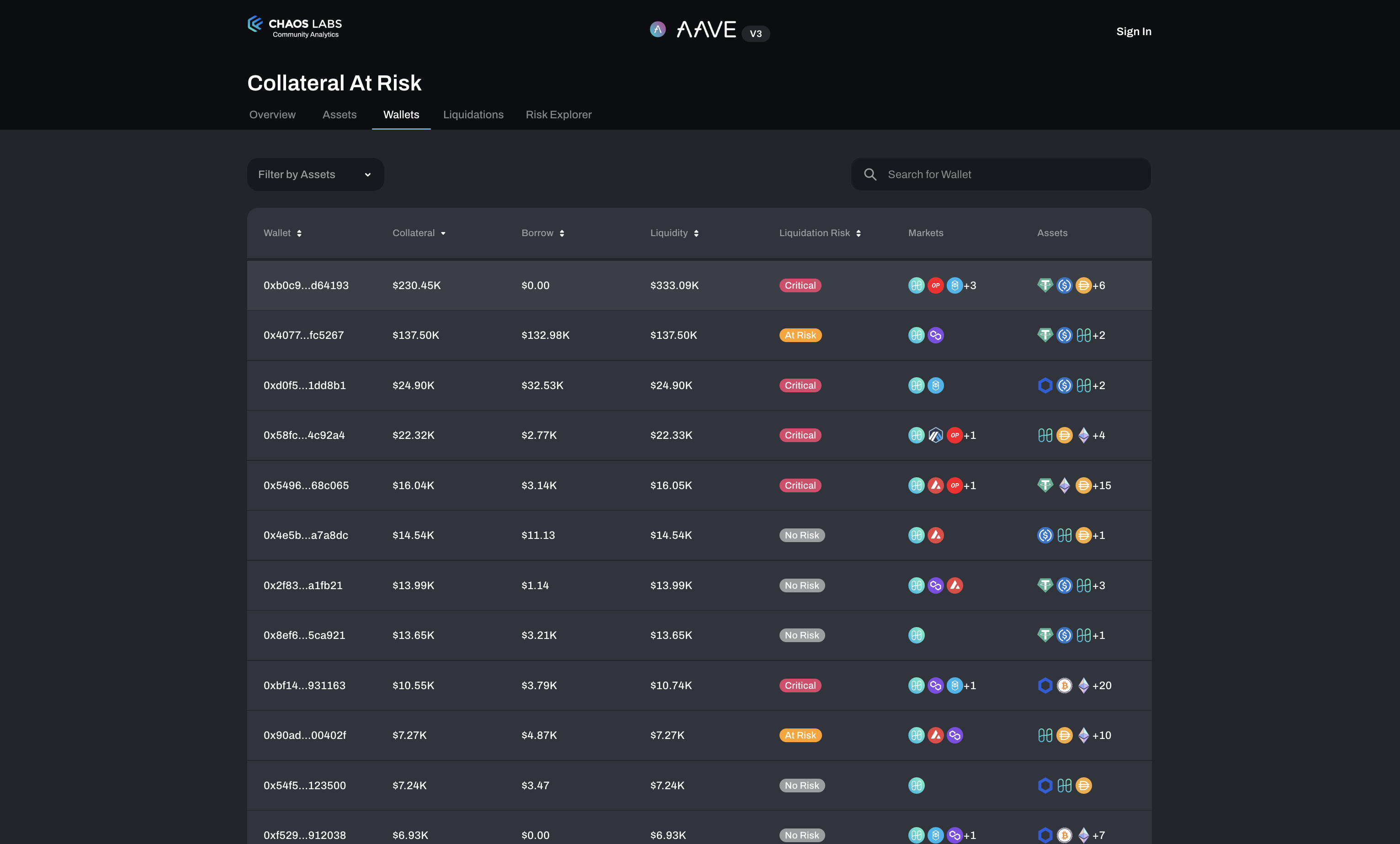

Wallets

This page aggregates all accounts that have ever interacted with AAVE v3 across all supported networks.

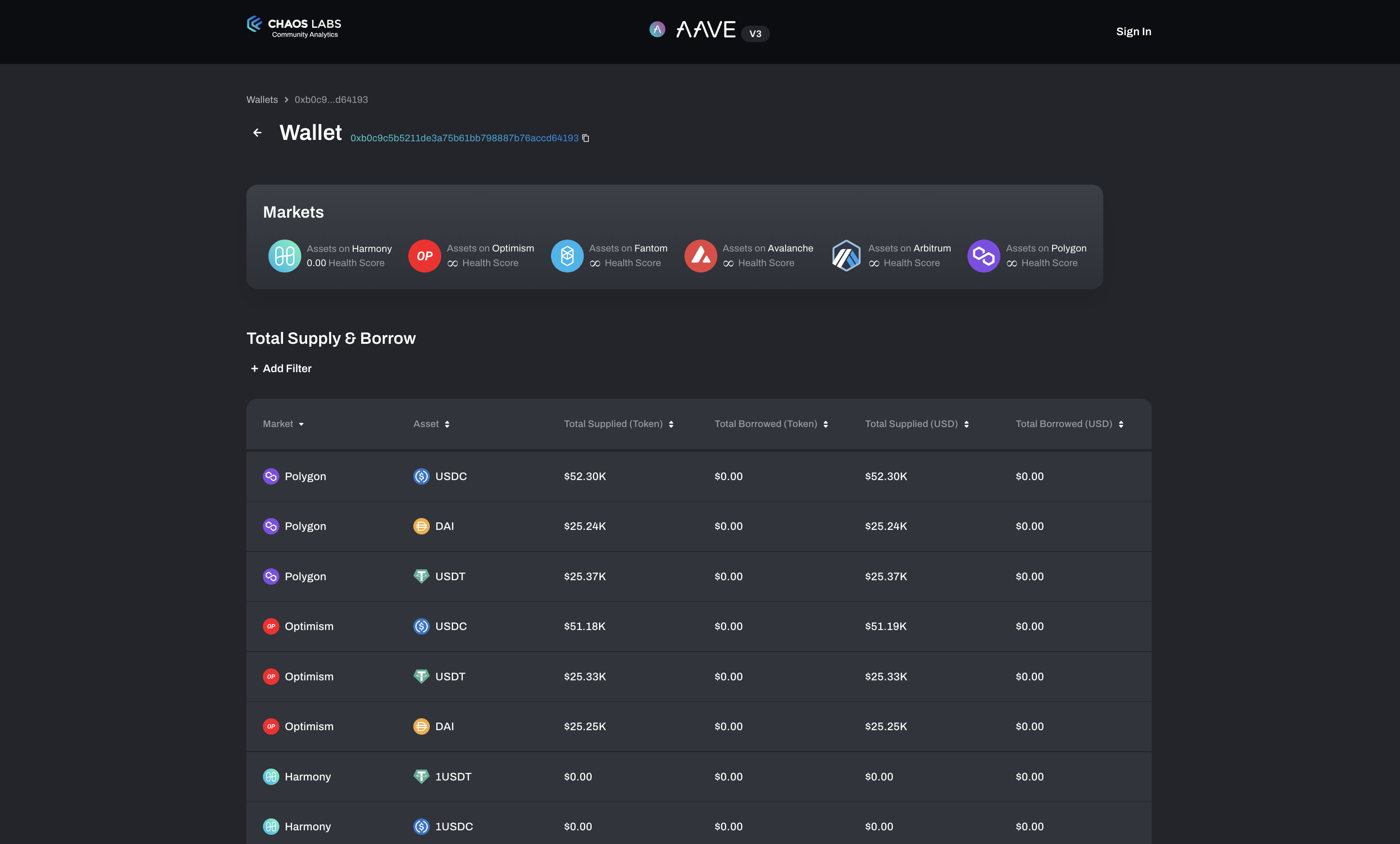

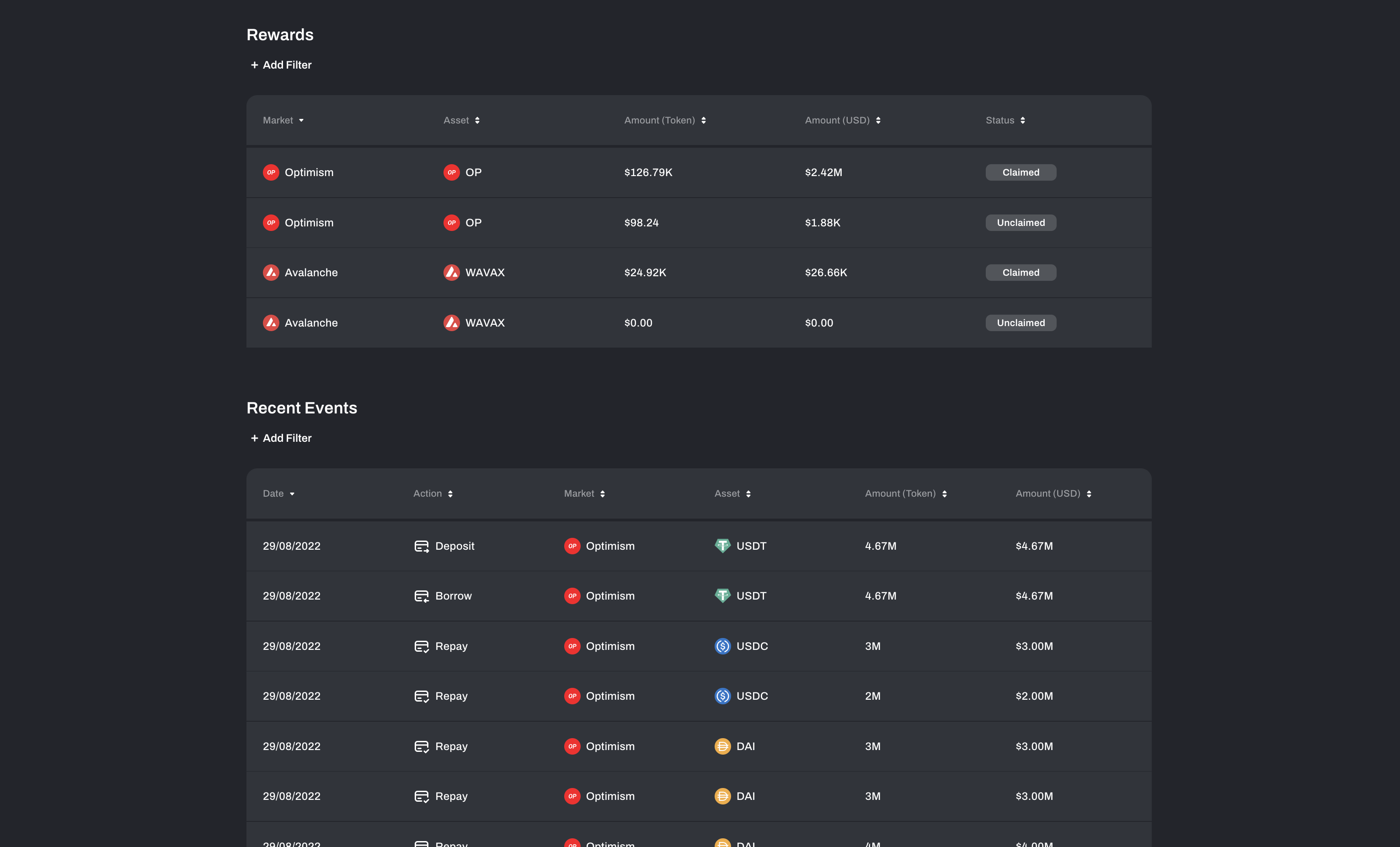

When clicking into a wallet we can see a profile with the following details:

- All active markets with health score.

- Detailed breakdown of AAVE positions.

- Detailed breakdown of accrued rewards.

- Collection of all events emitted from said account interacting with AAVE.

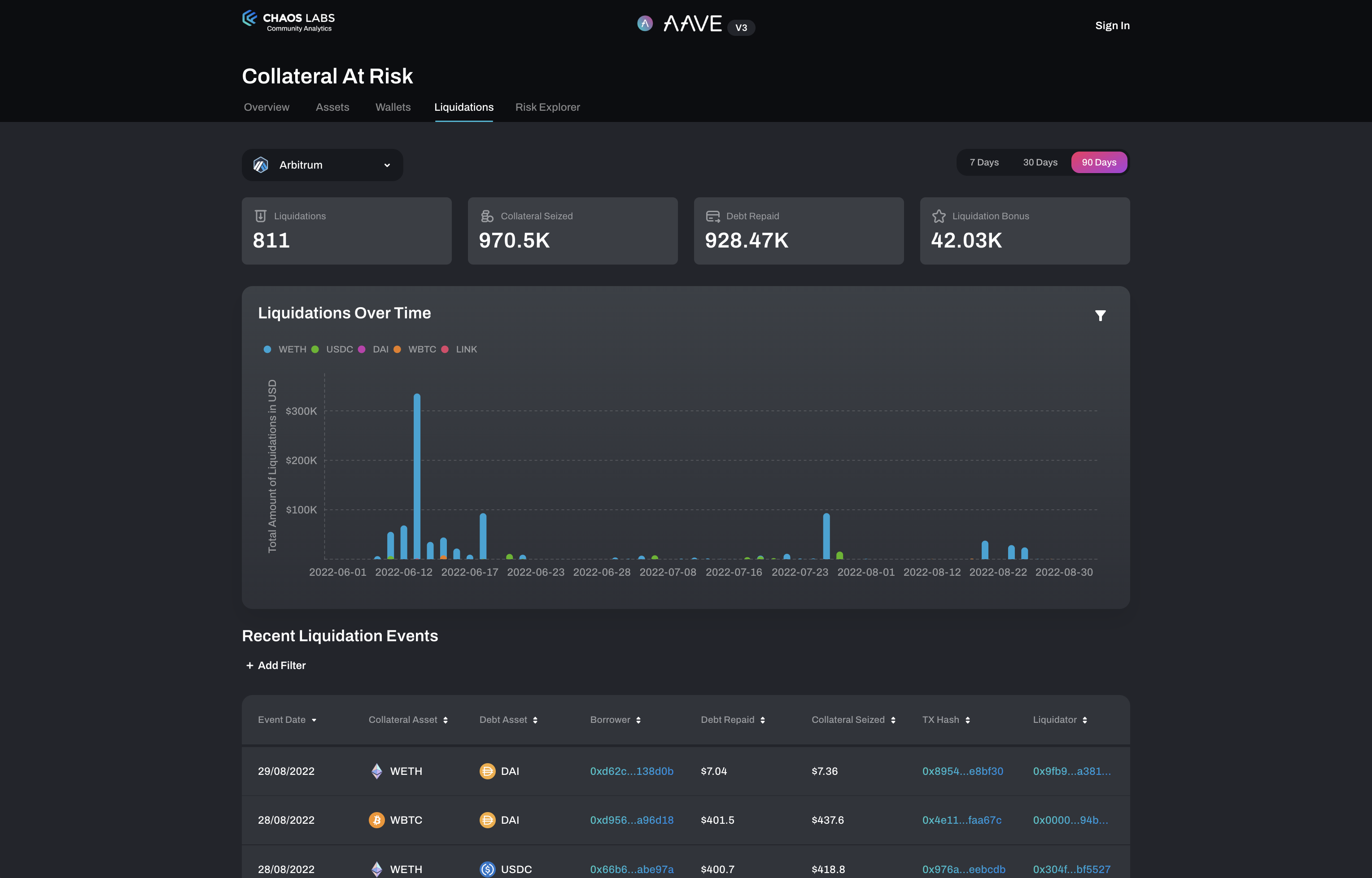

Liquidations

This page displayed in-depth liquidations data per network. Data displayed includes:

- Number of liquidations recorded

- Collateral seized

- Debt repaid

- Liquidation bonus

- Liquidations over time

- Recent liquidation events

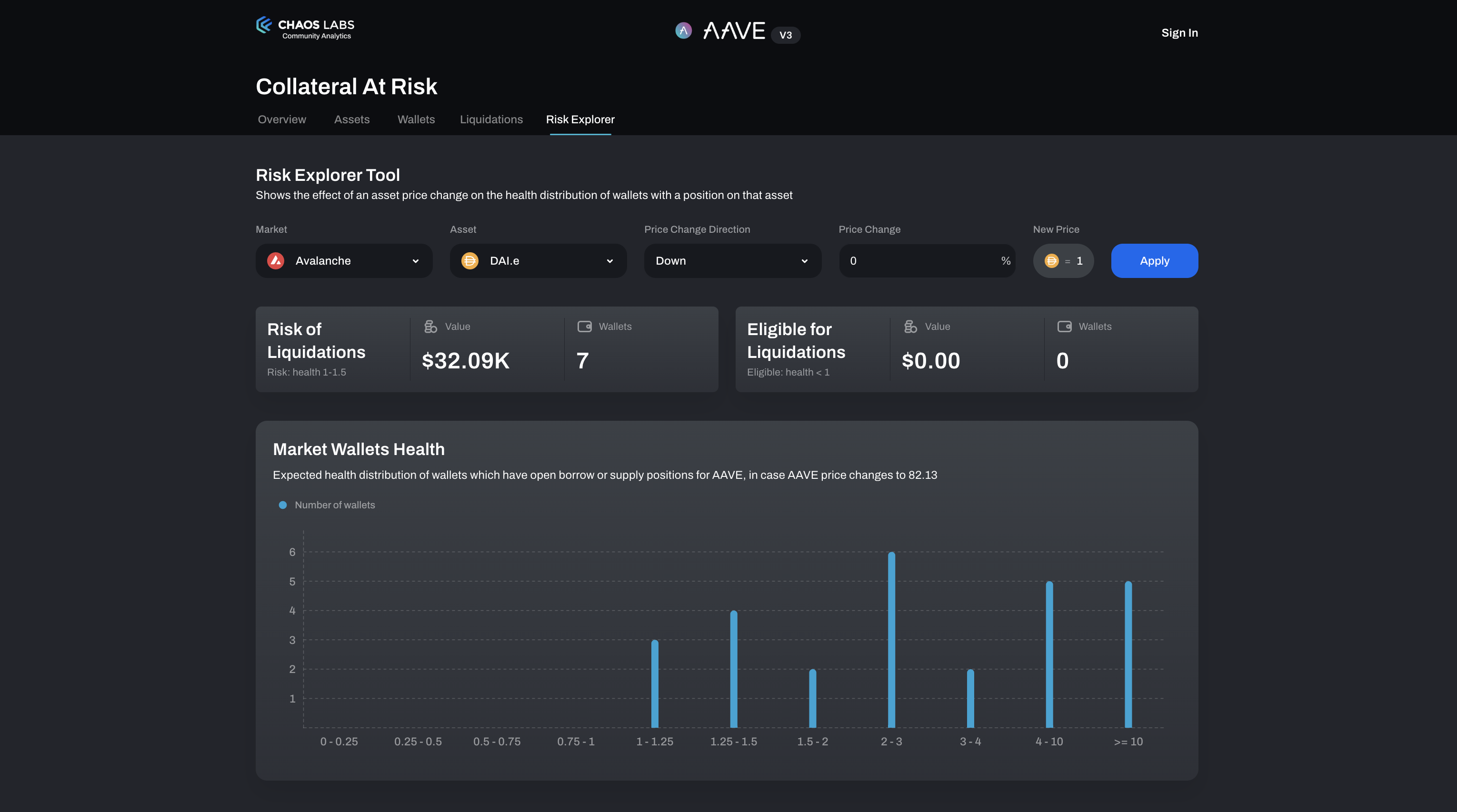

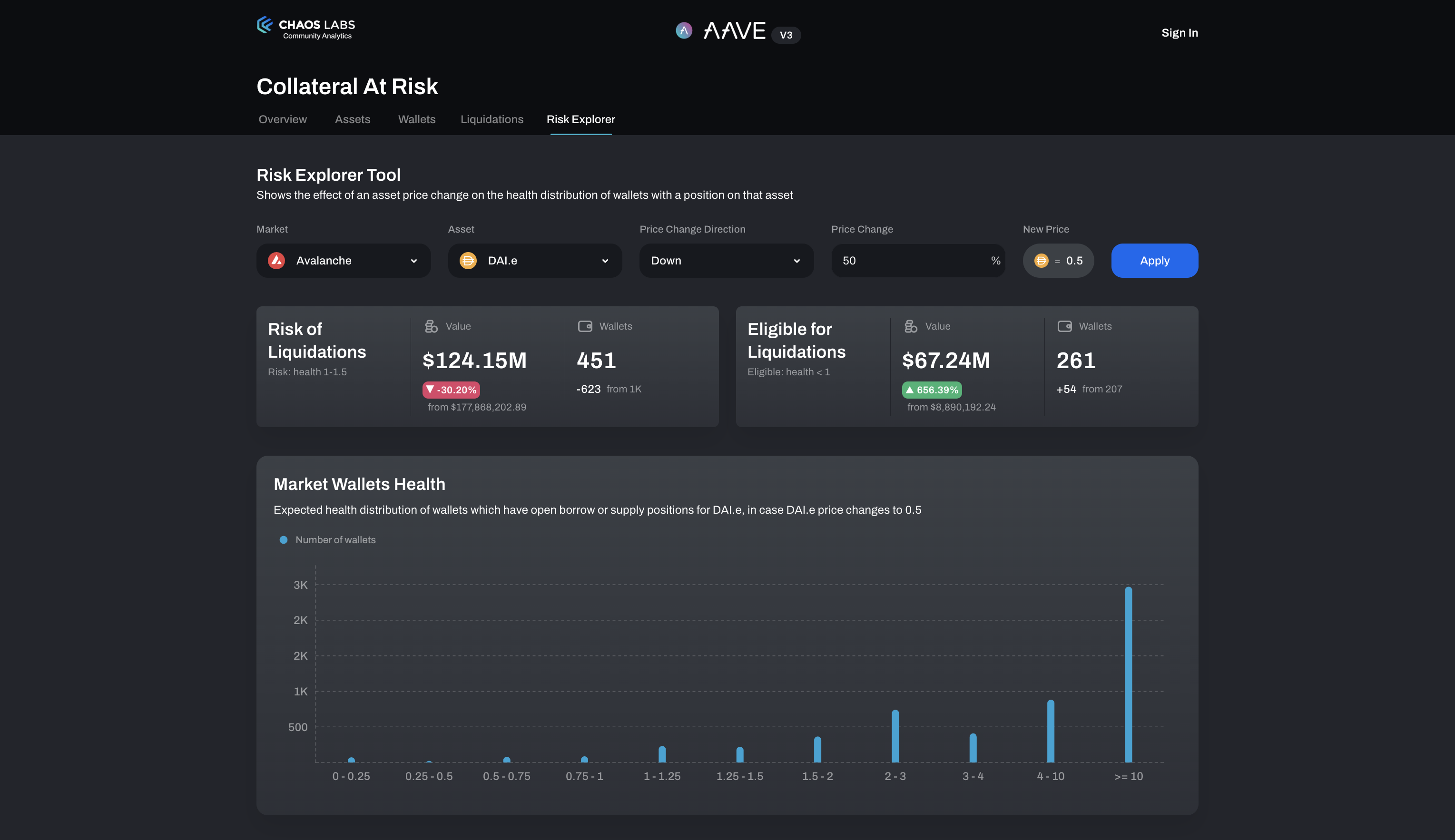

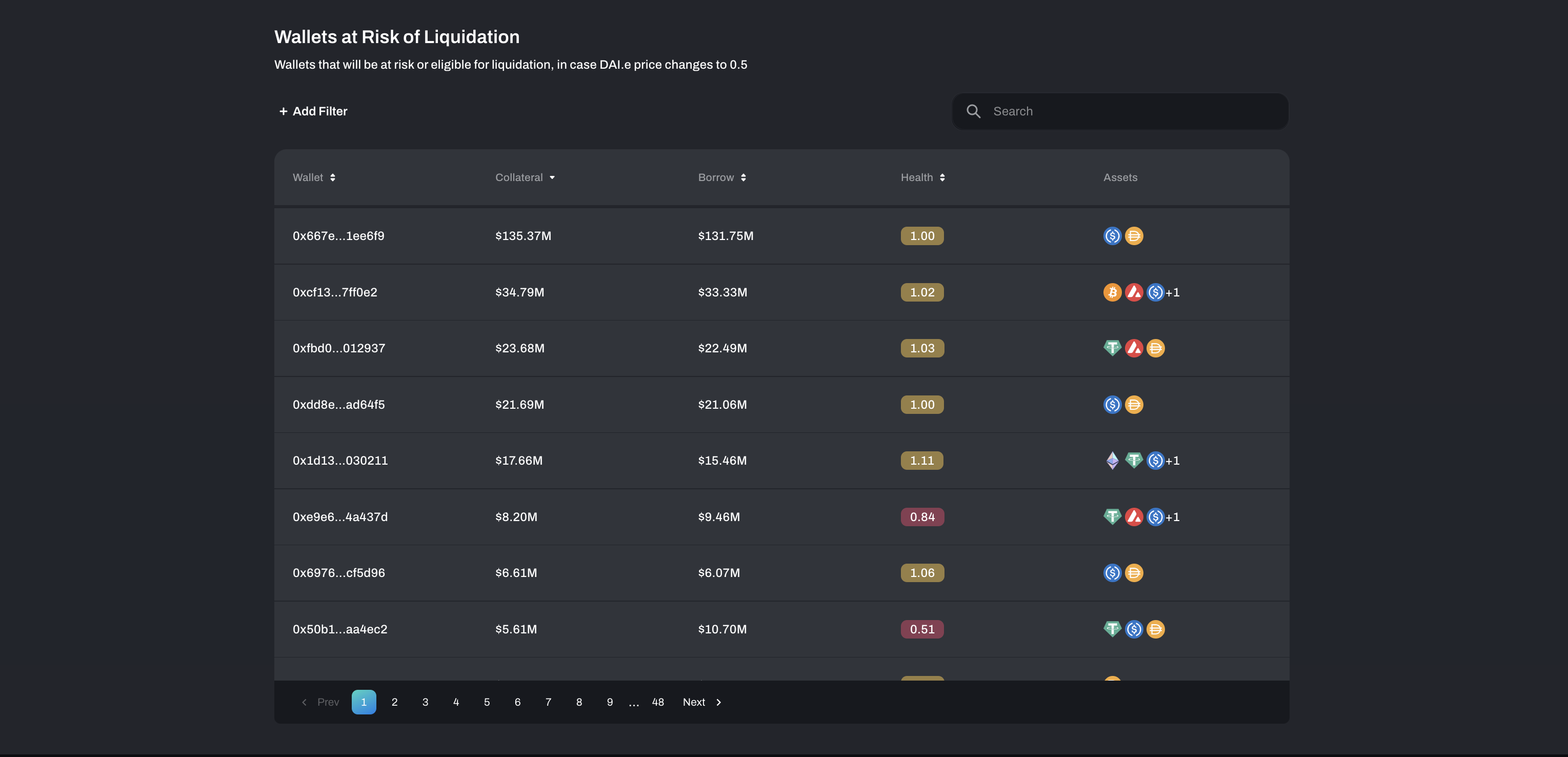

Risk Explorer

This page allows us to explore different risk scenarios. We can select a market, asset, and price change and run a computation that shows the effect of a price change on all wallets with a position on that asset. The risk explorer allows us to answer questions like, what happens if token $X price drops n%?

Notice the updated health scores for all wallets after we've updated the asset price.

What's next? ⏭️

This is only v0 of the AAVE Collateral at Risk dashboard!

We invite the community to reach out with feature requests or questions.

About the AAVE Grant Program

The AAVE v3 Collateral at Risk dashboard is supported by the AAVE Grants Program. If you want to learn more about the AAVE Grants Program, check out their blog.